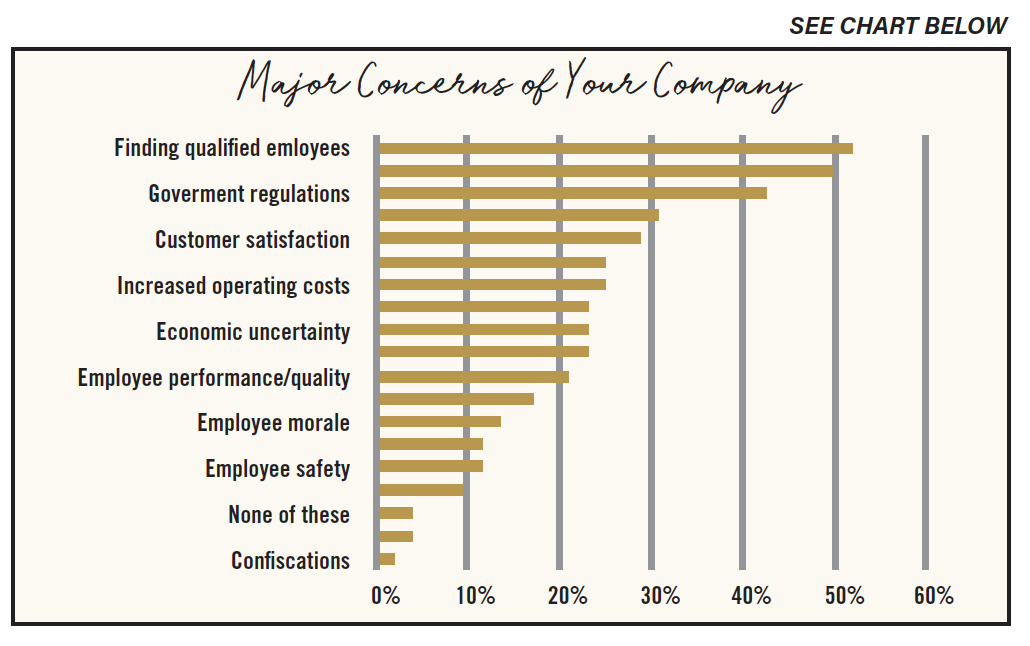

RECENTLY, THE NPA ASKED MEMBERS what three things were top of mind for them as they moved into the New Year. This poll was informal, but it was soon backed up by the results of the NPA Operating Report Benchmarking Survey. The top three things for 2021 are the top three things that were concerns in 2020, especially considering 2021 started with a new White House and a second year of COVID-19.

Although it was a concerning topic for 2020, COVID-19 seems to be old news in 2021. There were only a few responses asking when the world will get back to normal. It seems most people have moved on to the “new normal” of wearing masks, social distancing and operating their businesses accordingly.

“The most important thing on my mind leading into 2021 is determining when the world we live in will get back to some sense of normalcy. When will we be able to join in large groups and will we ever get rid of these masks?”

—Tim Collier, Pacer, Little Rock, AR

Another top concern of NPA members is how to find, train and manage employees in today’s world. In December 2020, Congress provided a temporary extension of unemployment aid as part of a $900 billion dollar package. Some pawnbrokers note that extended unemployment may have an impact on finding and hiring people to fill open positions. Those unemployment benefits phase out this month, and with record unemployment, finding new employees may become easier. Training and keeping them is another matter.

“I am concerned not only for employees’ well-being, but how can we find talented new employees to join our pawn family? If they expand unemployment benefits again, will our employees stay, and will we be able to find new ones?”

—Randi Nell, Big Dog Pawn, West Jordan, UT

How do you keep productive employees? In all business sectors, it has been proven that training helps retain good workers. This training needs to go beyond “here is where you clock in and there is the bathroom.” Employees need to know all the rules of the road at your business. Armed with a good handbook, new employees know upfront the policies of your store. A handbook also means that every employee is treated fairly, which is key if an employee decides to take legal action against you, or you need to terminate a bad employee.

“On my top three – finding employees, keeping good employees, getting rid of bad ones, training them to be good ones and not getting sued in the process.”

—Bill Dawson, Picasso Pawn, Morrisville NC

A serious issue for pawnbrokers right now is loan balances. COVID-19 kept many people out of stores. Add to that many received stimulus checks and enhanced unemployment, pawnbrokers find themselves not writing new loans, redeeming more loans, and running out of inventory to outright sell.

“Loan base. The next round of stimulus checks will be very hard on our loan bases. How can we attract new customers to help mitigate the redeems? Can our stores manage to stay profitable if everyone picks up all their loans and what can we do to bounce back faster?”

—Randi Nell, Big Dog Pawn, West Jordan, UT

Last year in March, the country was seeing lockdowns that applied to people and stores. No one was doing business in the traditional way. Then, on top of tax return season, which traditionally dampens the loan business, pawnbrokers saw the government giving people extra money, which took a greater toll on the loan business. What saved some pawnbrokers was being deemed essential workers. Those lucky enough to be essential could stay open, but their loans weren’t growing. Most were selling items such as video games, computers and televisions to entertain and provide a link to school to customers in lockdown until they ran out of stock.

So even with millions of people out of work, customers either couldn’t get out to a store or they had enough money to tide them over. Here we are in March again, with potentially another government stimulus check on the way. How do pawnbrokers combat low loan balances? It is an ongoing struggle pawnbrokers seem to be facing during this pandemic.

“Will the effects from the enhanced unemployment benefits and the stimulus money continue to keep new pawns down to never-before-seen low loan balances? Once income taxes become due, will there be a new round of pawns because folks need money to pay taxes instead of getting a refund?”

—Tim Collier, Pacer, Little Rock, AR

The number one topic on the minds of pawnbrokers right now is federal regulations, including rate caps and how regulation will affect the pawn industry. The NPA GRC Team is keeping an eye on legislation happening all around the country, but especially in Washington. They tirelessly work to educate lawmakers about the value of pawn and its place as the only recourse for customers who need a quick, small-dollar loan.

“What concerns me is the Consumer Protection Bureau flexing their muscles after being dormant for four years.”

— Ken Huddleston, KK’s Loans, Music & Jewelry, Manchester, TN

The issues you are facing are being faced by pawnbrokers across the nation and together at the NPA, we remain committed to serving and protecting this industry.

“Here is what we all need to concentrate on now. The threat of a 36 percent federal rate cap is very real. This isn’t just my state, or your state…this affects 10,000 pawnbrokers in the United States! This is about fighting the good fight for our industry no matter what your political affiliation. The NPA and their lobbyists have been fighting a rate cap for years — much of it being done without any of our knowledge. It is time to support them so they can continue to help us. It is time to not worry about your competitor and reach out to the other shops in your city, county, neighborhood and state and try to get them to help us win this fight.”

—Cory Brown, Pawn USA, Woodbridge, VA